Understand Your Customers and Competitors with Alternative Data Insights

Alternative Data Use Cases for Commercial Banks

Understand Your Customers and Competitors with Alternative Insights

Commercial banks need real-time information to understand and grow their customer base, stay ahead of market trends, and gain an edge over competitors.

Read on to learn how customer reviews, social media traction, corporate job listings, and other sources of web-based alternative data drive business decisions and competitive intelligence efforts.

COMMERCIAL BANKS DATASETS

Leverage User Reviews to Empower Your Products

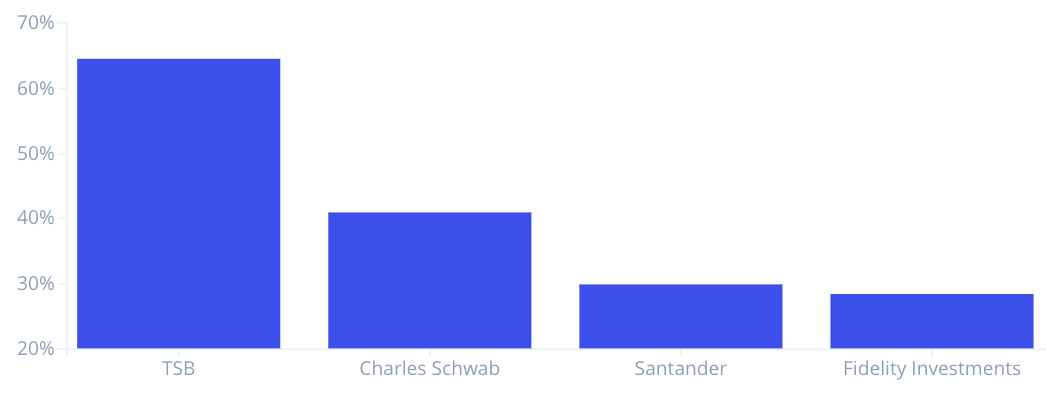

Challenge: The profusion of new banking and payments services means consumers are spoiled for choice. So product managers at commercial banks must track their own users’ reviews, and benchmark against competitors, in real time.

Thinknum Solution: We index quantitative and qualitative user reviews for financial products across platforms including Apple, Google, and TrustPilot. Benchmark against your competitors in real-time, and stay ahead in the race for customer satisfaction with granular data on each review.

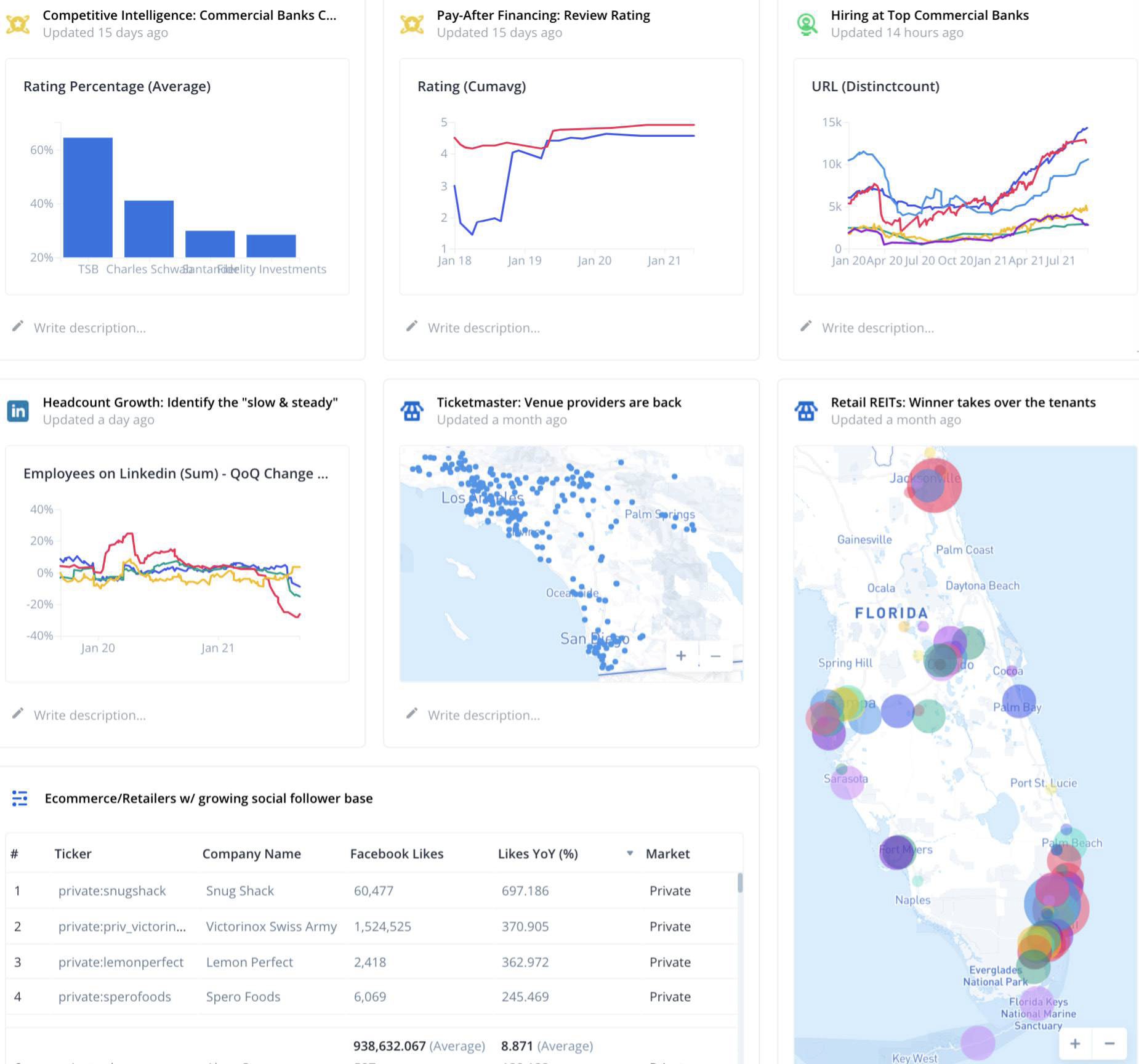

User Reviews - Data Insight: TSB is winning its customers’ hearts and minds, according to user reviews on Trustpilot: it has the highest customer satisfaction score amongst its peers, with an average score of 64%. Fidelity Investments lags behind, with an average score of just 28%.

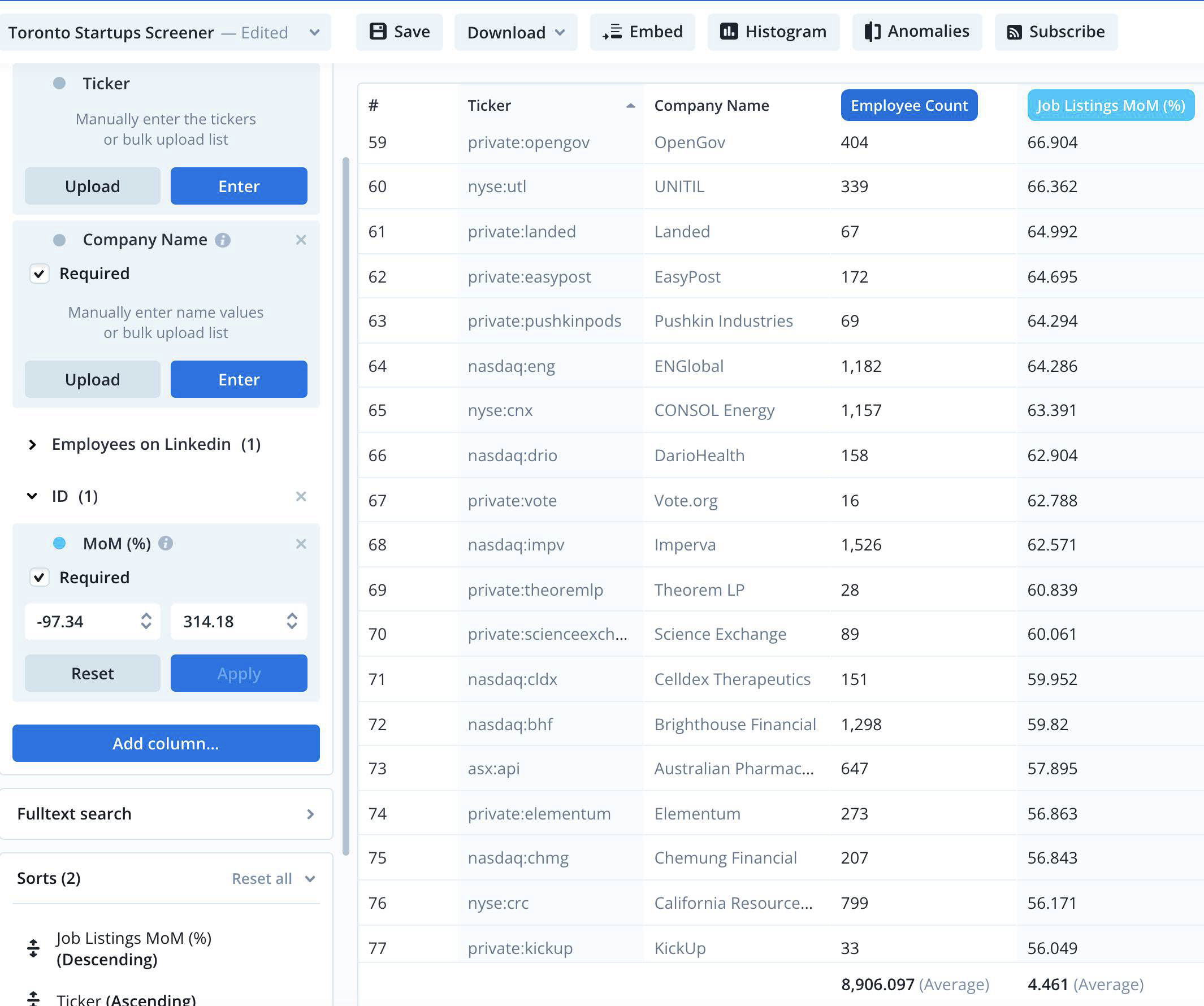

Track Hiring & Expansion Through Job Listings

Challenge: To attract and retain top talent, HR leaders must understand their competitors’ hiring strategy. Who is expanding or contracting, and what roles and locations are they targeting?

Thinknum Solution: Track the number of open job listings at tens of thousands of companies in real time. Filter to gain granular insights on specific market, location, and job categories - and get inside your competitors’ heads.

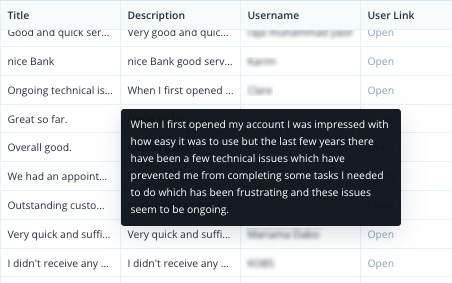

Job Listings - Data Insight: The recent talent war across the United States has sent large banks on a hiring spree. Citi has led the way amongst peers, with 14.2K open job listings as of September 2021.

Understand Competitor’s Corporate Development Strategies

Challenge: People analytics teams must track changes in competitors’ open job categories to understand their hiring, management, and growth strategy.

Thinknum Solution: Visualize thousands of job descriptions through our word cloud for insights into competitors’ hiring tactics, or for competitive positioning of your job listings.

Job Listings - Data Insight: TD Bank is aggressively expanding its Retail Banking, Sales & Business Development, and Wealth Management divisions.

Know Your Customer Loan Issuance & Business Growth

Challenge: Find qualified prospects for loan issuance and business growth.

Thinknum Solution: Hiring is a leading indicator of future corporate performance. Lenders leverage our job listings data for lead generation and risk management. With our screener tool you can track, filter and set alerts for changes in hiring trends for your existing clients, as well as target prospects.

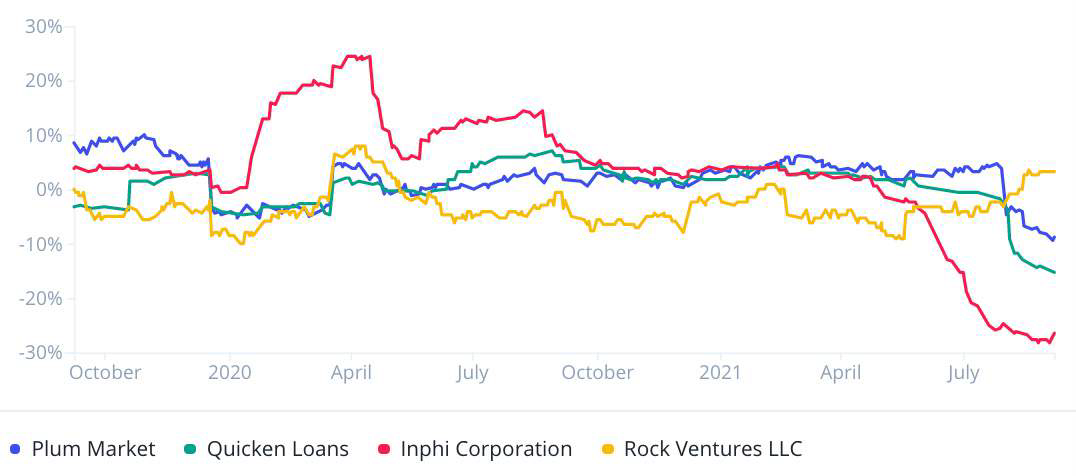

Track Headcount Growth

Challenge: Track companies’ expansion and layoffs in real time - for lead generation, KYC, and risk management.

Thinknum Solution: Thinknum’s headcount data helps banks find companies that are experiencing slowed growth and financial hardship in real-time to better target prospective clients.

LinkedIn Headcount Growth - Data Insight

Successful companies like Plum Market, Quicken Loans, Inphi Corporation, and Rock Ventures resorted to steep layoffs to get through the pandemic. Promising companies that display signs of financial hardship can be prime prospects for commercial lenders.

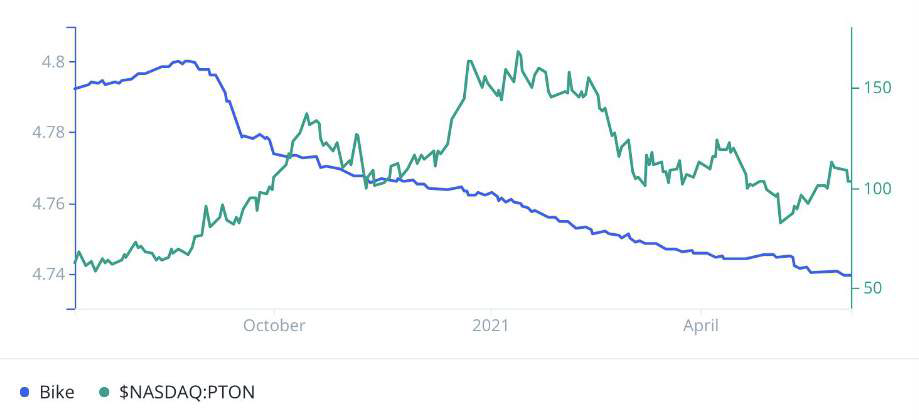

Leverage User Reviews to Make Smarter Lending Decisions

Challenge: Understand a company’s standing in the eyes of their customers - for KYC and risk management.

Thinknum Solution: Our data tracks quantitative and qualitative user reviews across platforms including Apple, Google, and Trustpilot - so lenders can manage credit risk proactively. Commercial banks can track their clients’ and prospects’ product quality, brand positioning, and ability to deliver goods and services to their customers.

Customer Reviews - Data Insight: User reviews for Peloton bikes started dipping months before the company - in cooperation with the U.S. Consumer Product Safety Commission - announced a recall of 54,000 faulty pedals. The October 2020 recall marked the beginning of Peloton’s stock price stagnation.

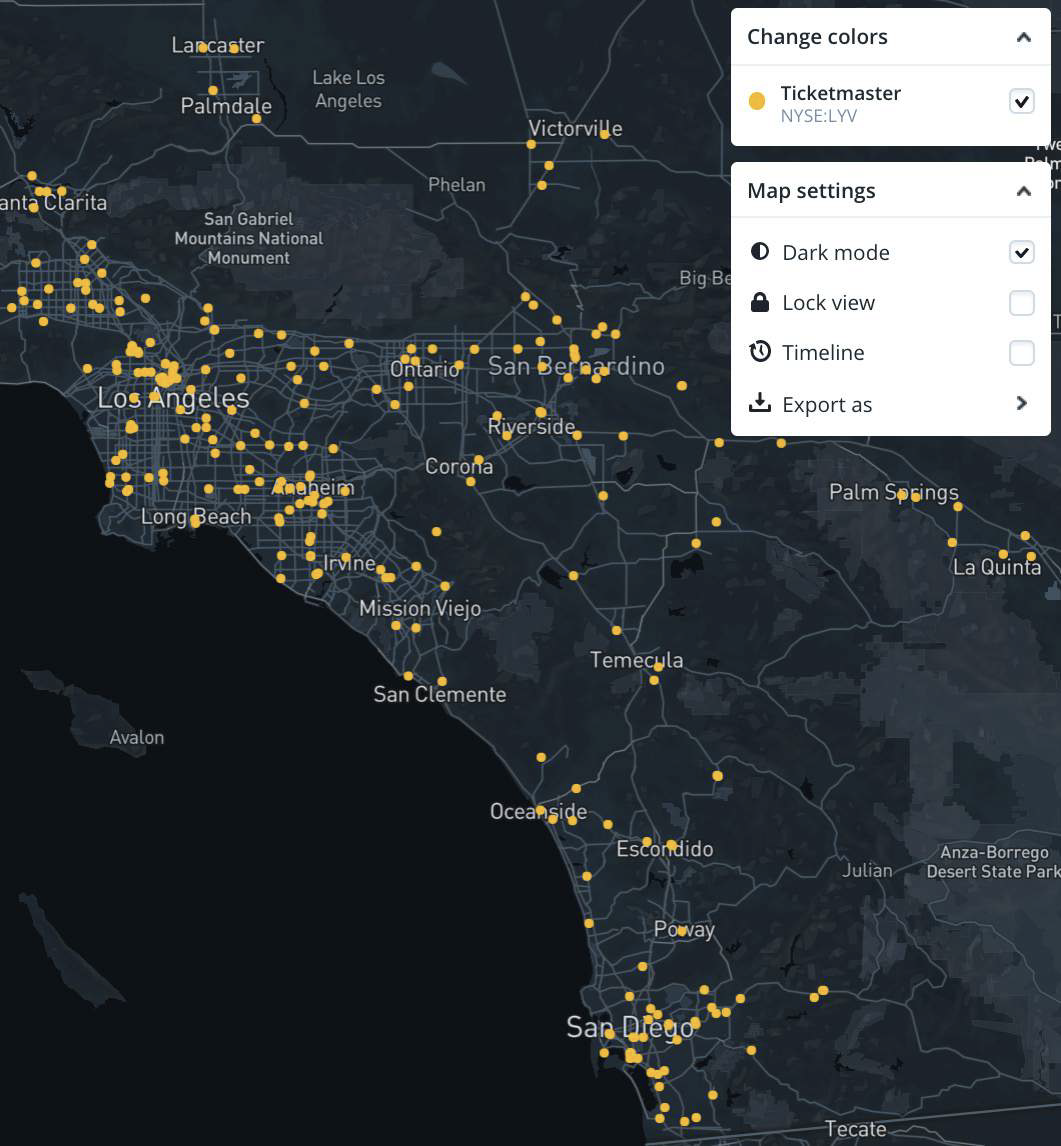

Local Lending:Lead Generation via Location Data

Challenge: Understand where capital is needed ahead of your competition.

Thinknum Solution: Our Store Locations dataset allows users to compare brick-and-mortar locations across companies in a user-friendly map - a powerful tool for lead generation, competitive intelligence, and more. You can now track economic activity at the county, district and city-level.

Store Locations-Data Insight

As restrictions are lifted and live events make a comeback, the number of concerts and shows listed on Ticketmaster has reached 1.68K across the US. As in-person live events return across the world, map the real-time key locations where venues are opening back up. These are prime targets for businesses that might lack liquidity, and benefit from loan assistance.

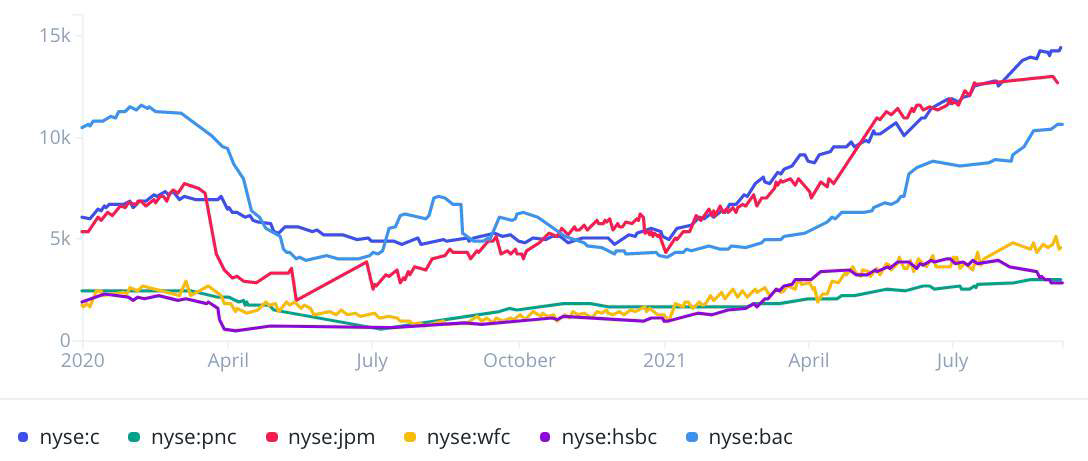

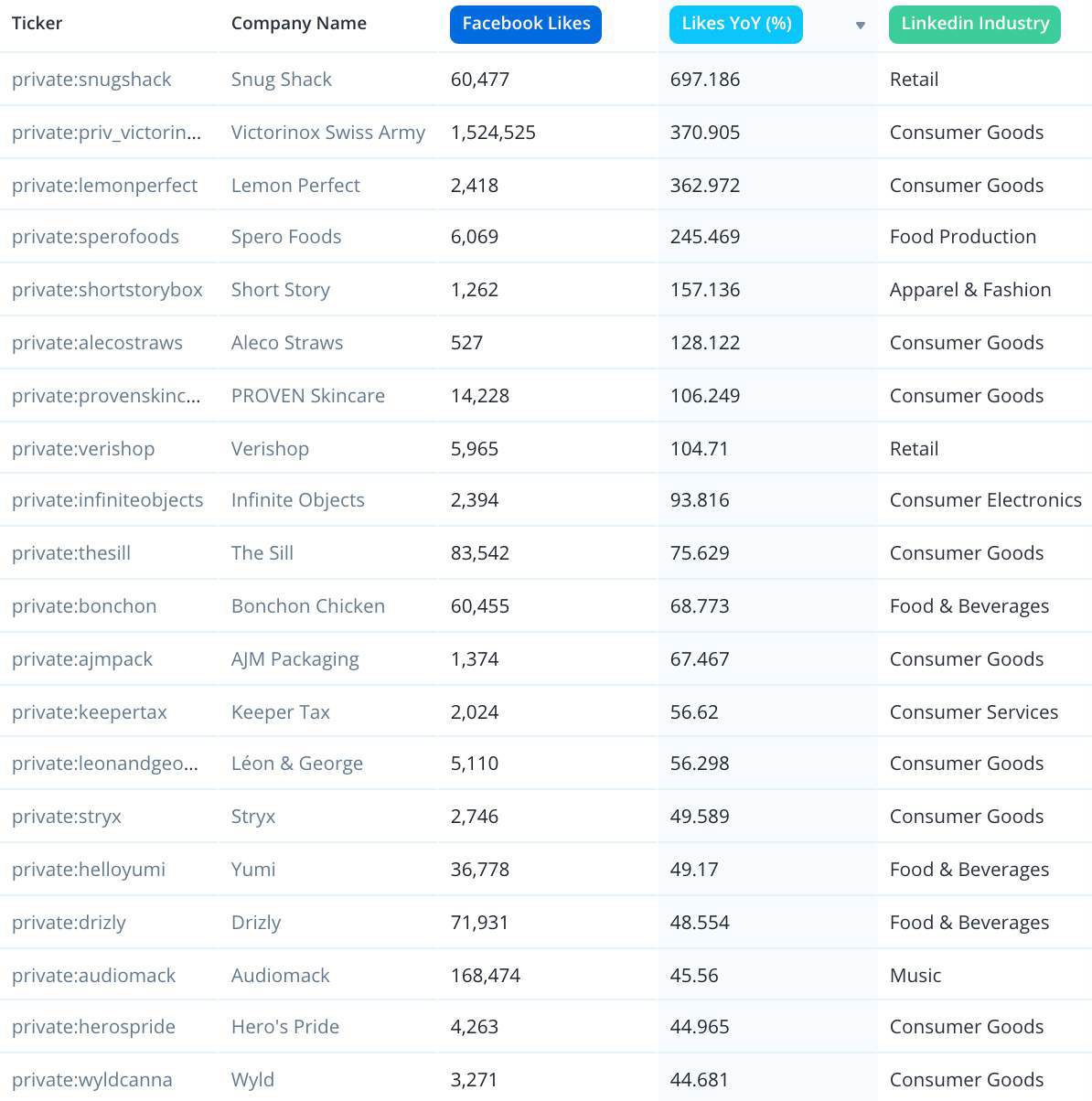

Leverage Social Media Data to Identify High-Growth Private Companies

Challenge: Track what the world is saying about your clients and prospects across major social media outlets in real time, to support business decisions.

Thinknum Solution: Rank private companies based on follower growth across Facebook, Instagram, Twitter, and other major platforms. Followers, ‘likes,’ and engagements measure popularity - and are a good indicator of shifting tastes and market movements.

Key Takeaways

Innovative lenders leverage alternative web data to know their customers, manage risk, and generate leads. Thinknum’s corporate job listings and headcount data empowers people analytics and competitive intelligence teams to get inside their competitors heads.

Our user reviews data enables banks with business-to-consumer products to benchmark against competitors in real-time, in order to stay ahead in the race for customer satisfaction