OpenAI salary data reveals new strategic focus on AI Safety and Security

Hiring trends at OpenAI are an early indicator of where the company — and the broader AI industry — is heading next. With 451 open job listings, representing a 201% year-over-year increase, OpenAI is investing aggressively in both scale and capability expansion.

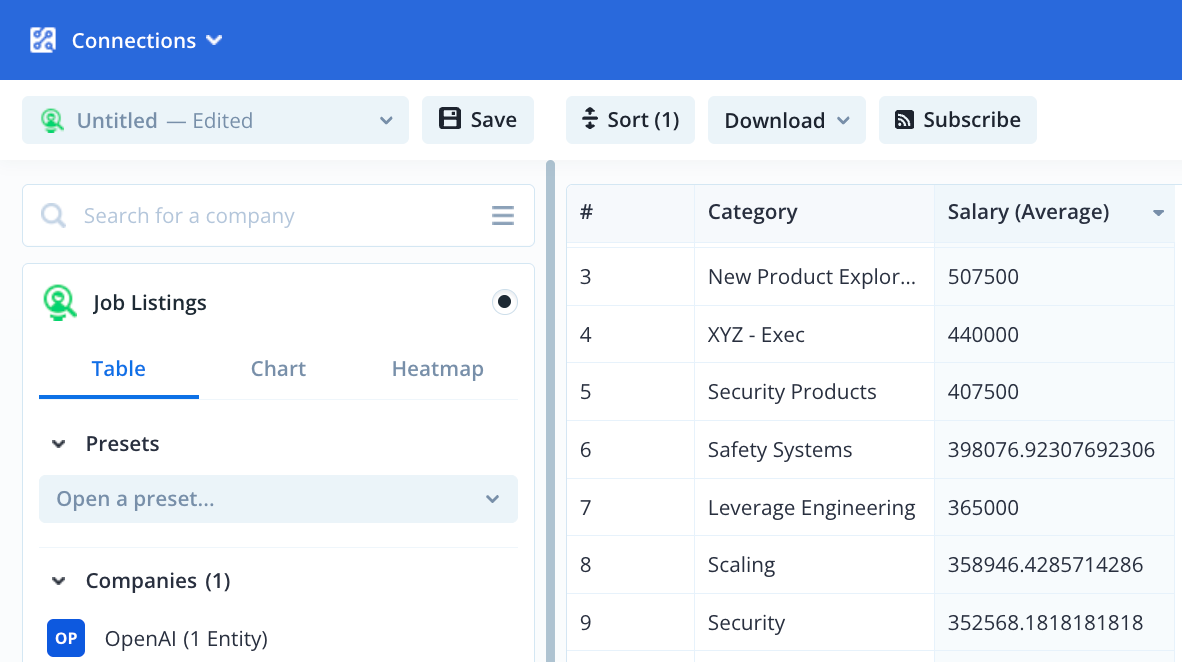

But the most valuable signal for investors lies underneath the headcount growth. Our salary allocation data reveals that OpenAI is willing to pay a premium for roles in its Security and Safety Systems teams.

Strategic Priority Areas Reflected in Compensation

The largest hiring clusters today

Read more