Weave Alternative Data into Your Long-Term Investment Strategies

An Investor’s Guide to long-Term Success

Weave Alternative Data Insights into Your Investment Strategy

Alternative data provides an investing edge across a myriad of industries. Investors who are building portfolios long term need to capture major changes before everyone else. Alternative data allows them to get inside the heads of corporate management.

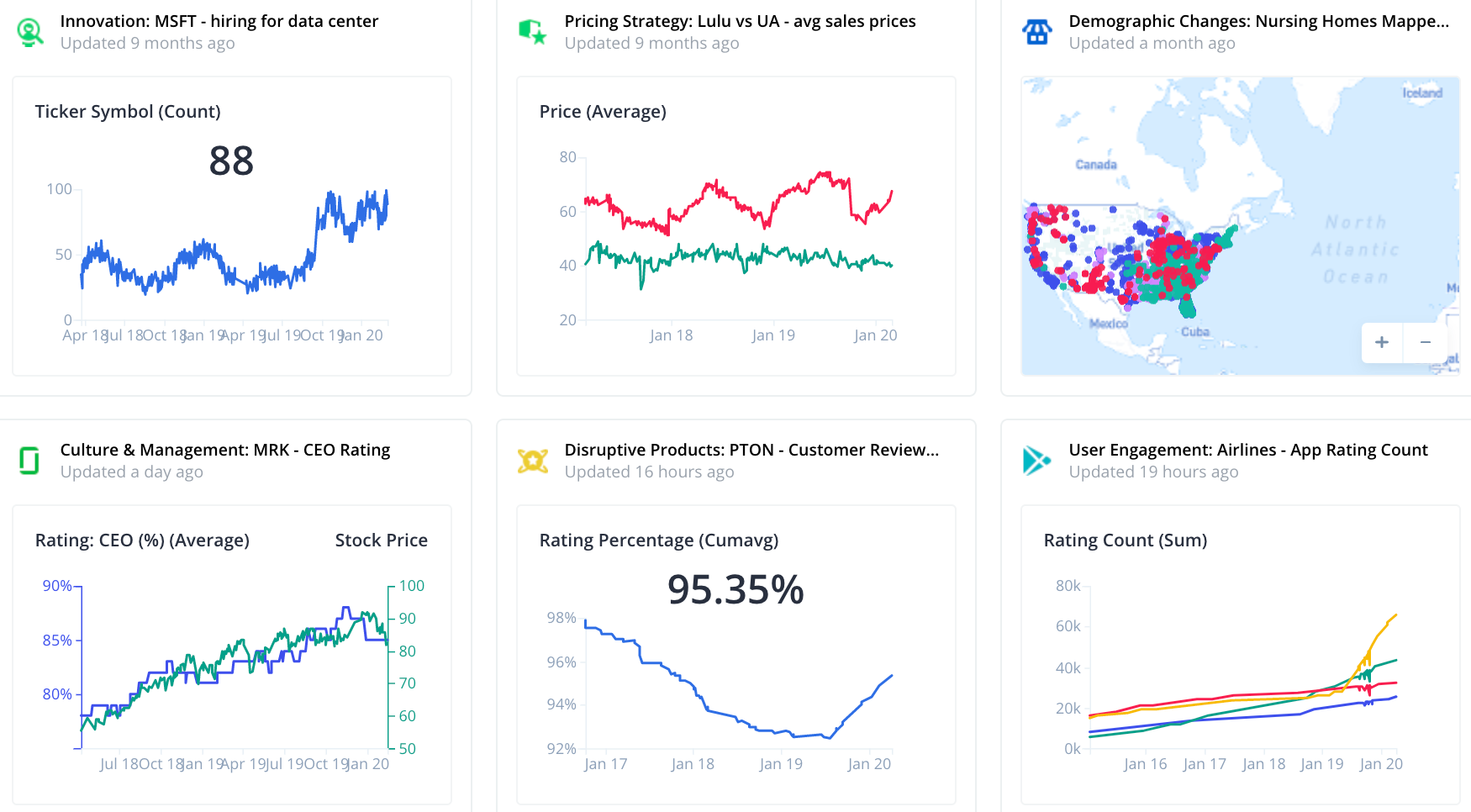

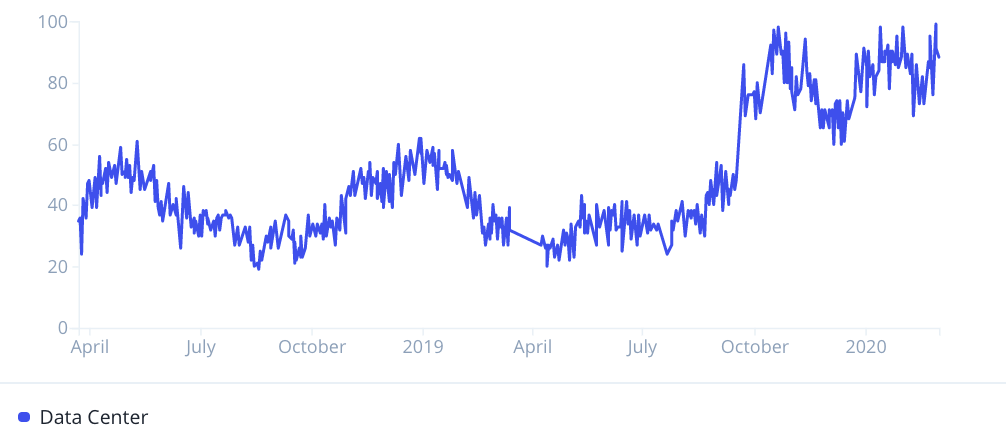

Innovation Fuels Future Growth

Companies invest in strategies that they believe they can get an advantage in when major trends play out. For example, job listings data shows how and where a company is planning to grow. Investors can look back historically to see whether the companies made the right bets at a given moment in time.

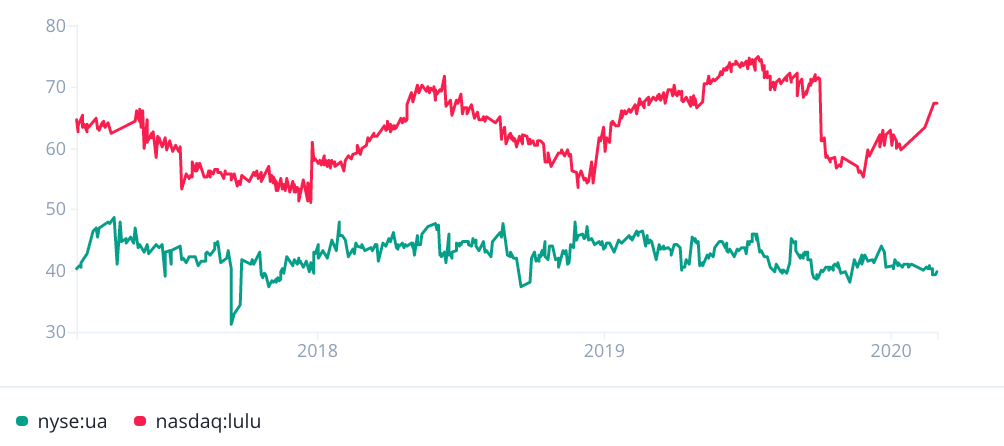

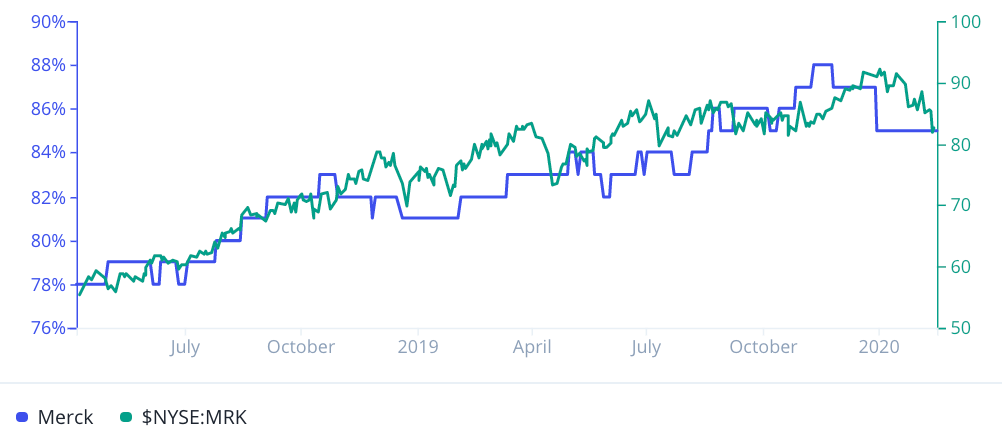

Pricing Strategies Predict Long-Term Success

A company’s pricing strategy can predict how well its products are selling, both in the short and long term. Investors can get a sense of how companies are managing inventory and how their products are perceived relative to their competition. For example, the average discount for all products sold by a company in real time can tell investors what the demand is for their products.

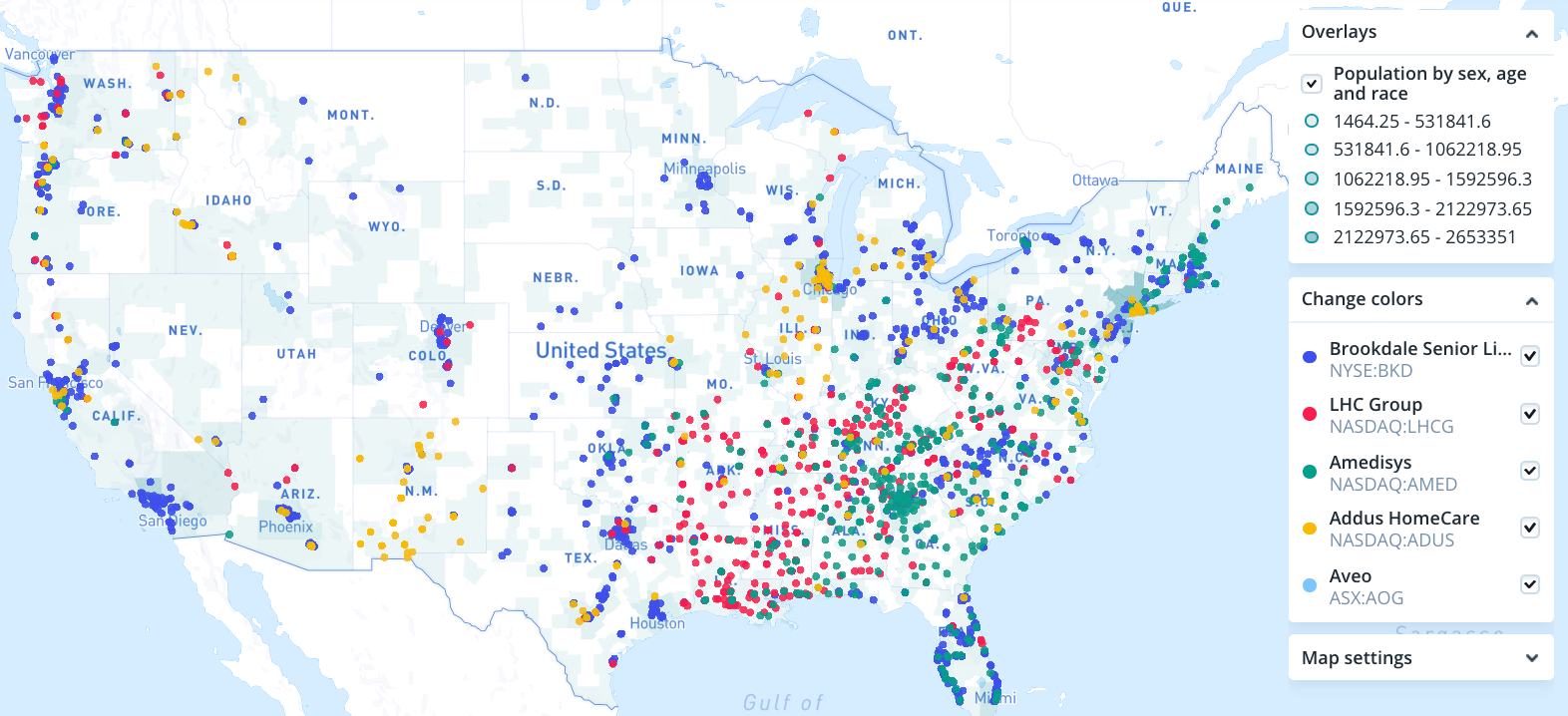

Profit from Changing Demographics

Communities get older. People move towards certain locations. Investors can identify which companies will benefit and which companies will not from changing demographics.

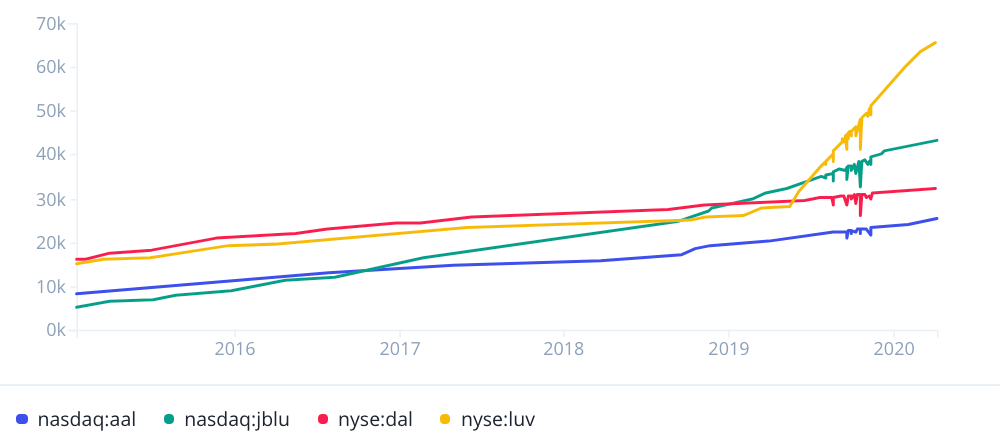

Better Culture Yields Higher Returns

Investors started to realize the importance of employee sentiment as they found out that toxic work environments erode margins. Happy employees have been proven to drive returns, so the savviest investors are analyzing which companies have a positive culture.

Using Mobile App Data to Track Engagement

Mobile apps are much more popular than they were a decade ago. Companies use mobile apps as a portal to collect information for many purposes. With mobile app data updated on a daily basis, investors will be able to track which companies are building apps that engage their users.

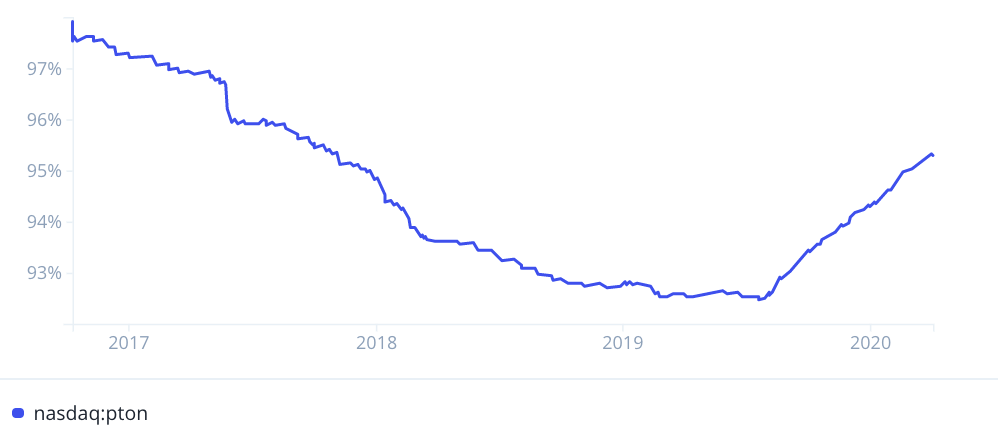

Product Reviews Quantify Disruption

Disruption happens when new products revolutionize consumer behavior. User reviews data allows investors to track upcoming innovative products and how they are being received in the market. They can also track when user sentiment shifts away from new products.