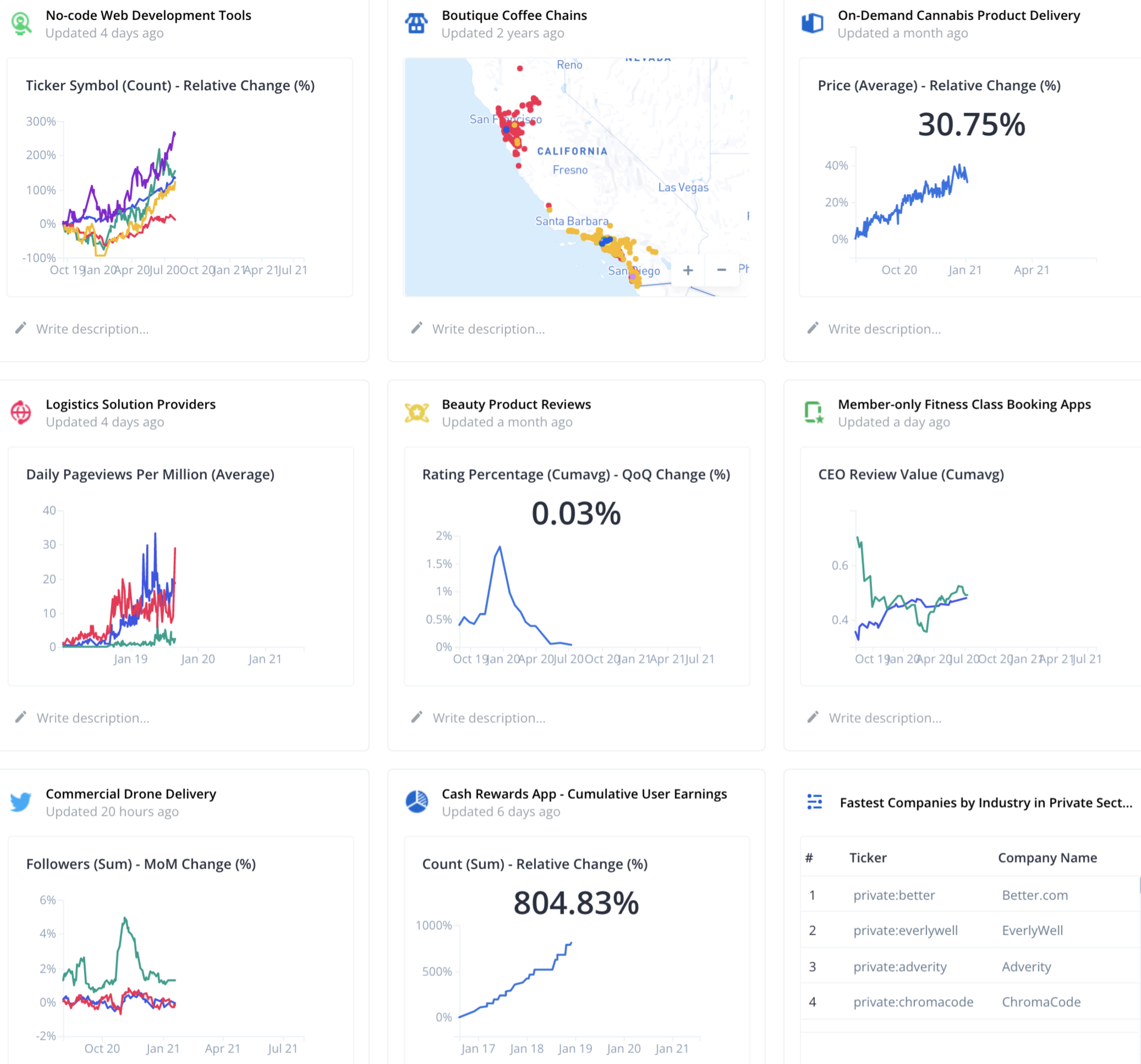

See Through the Bull: Track Private Business Activity Like Never Before with Alternative Data

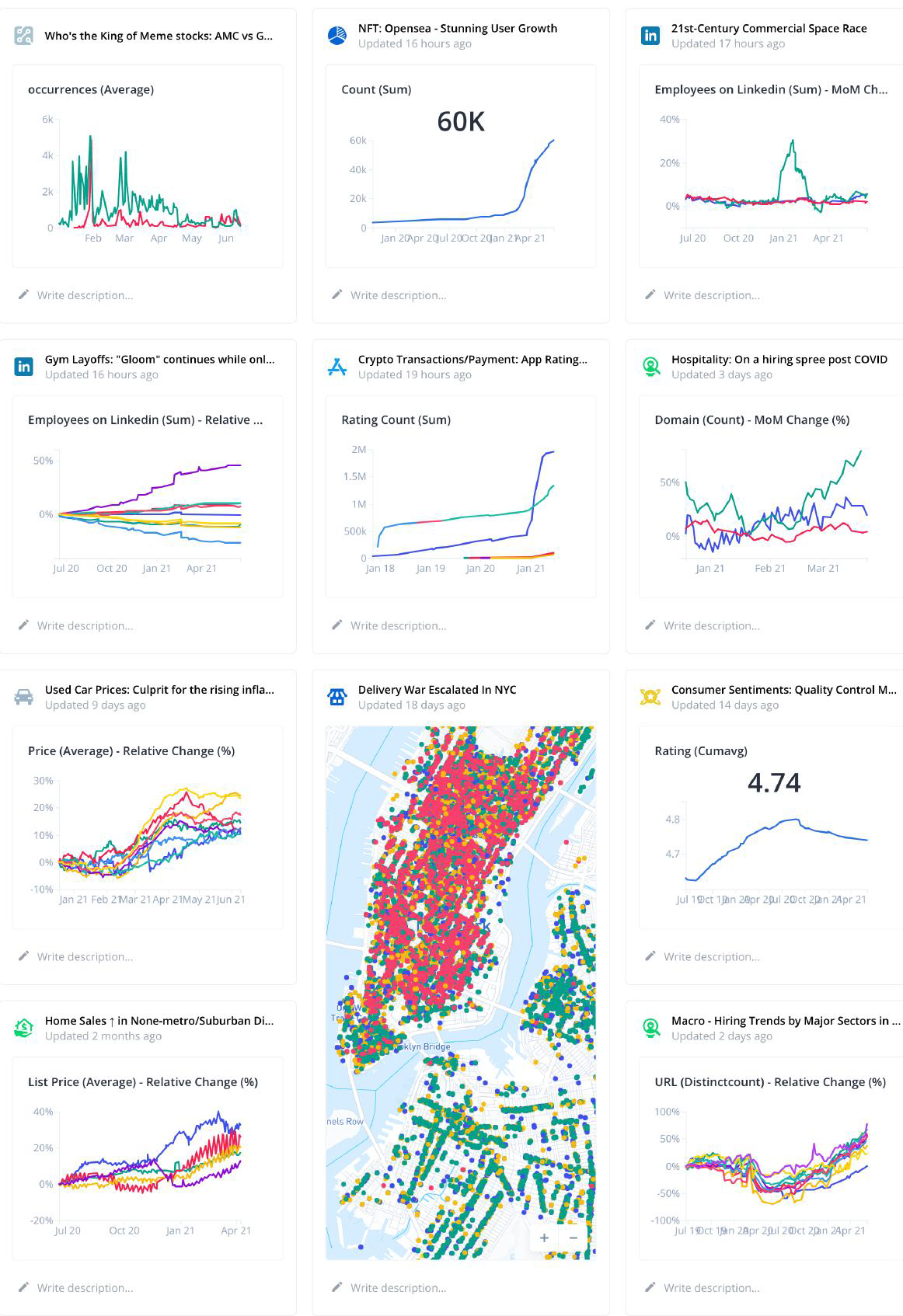

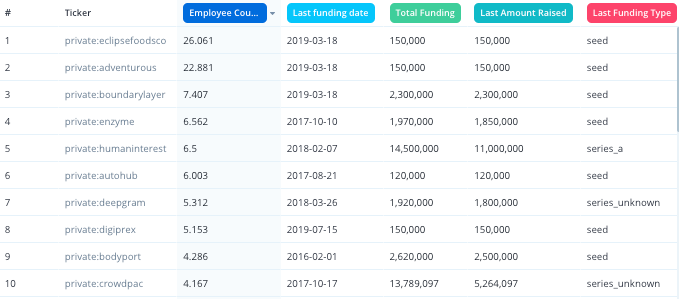

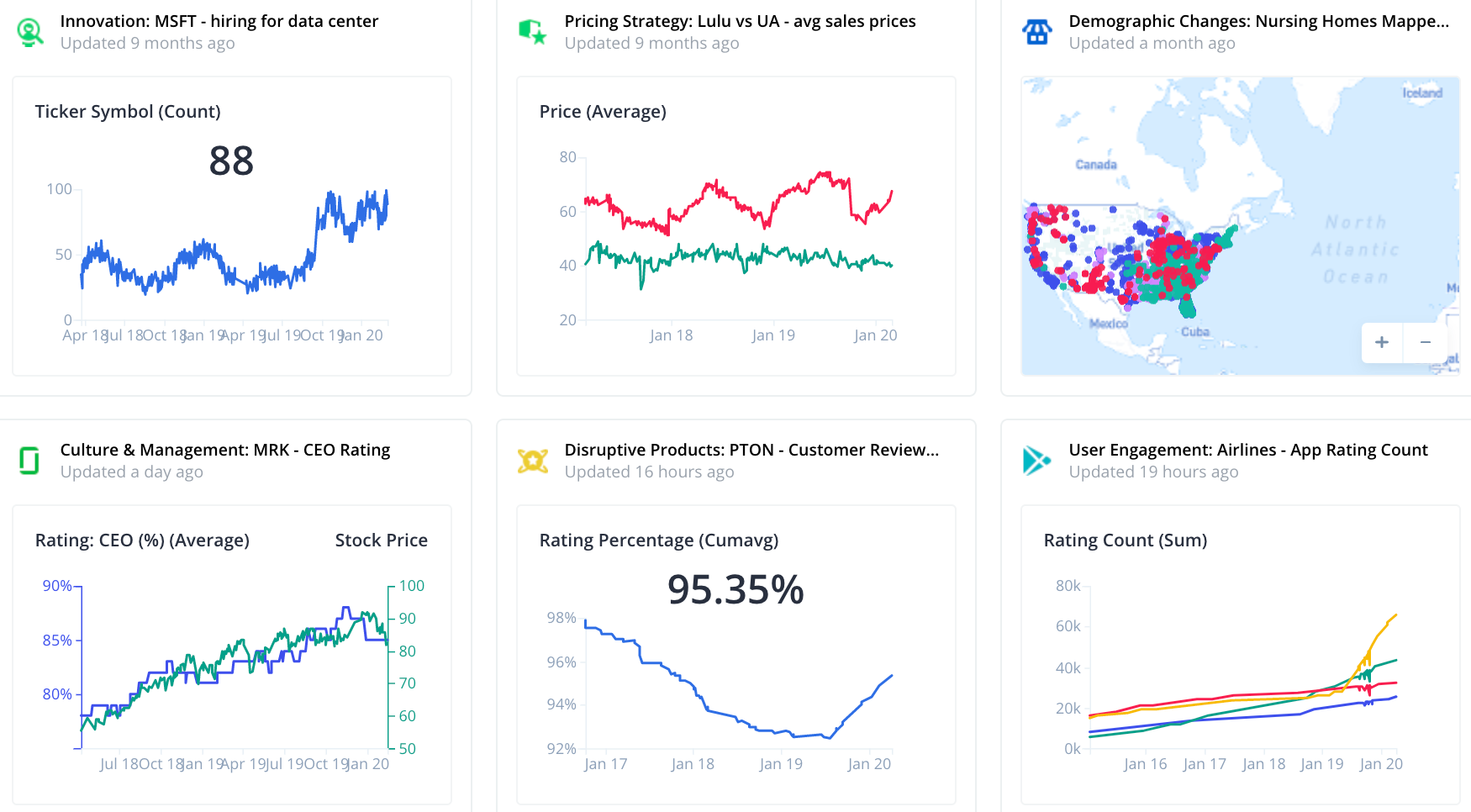

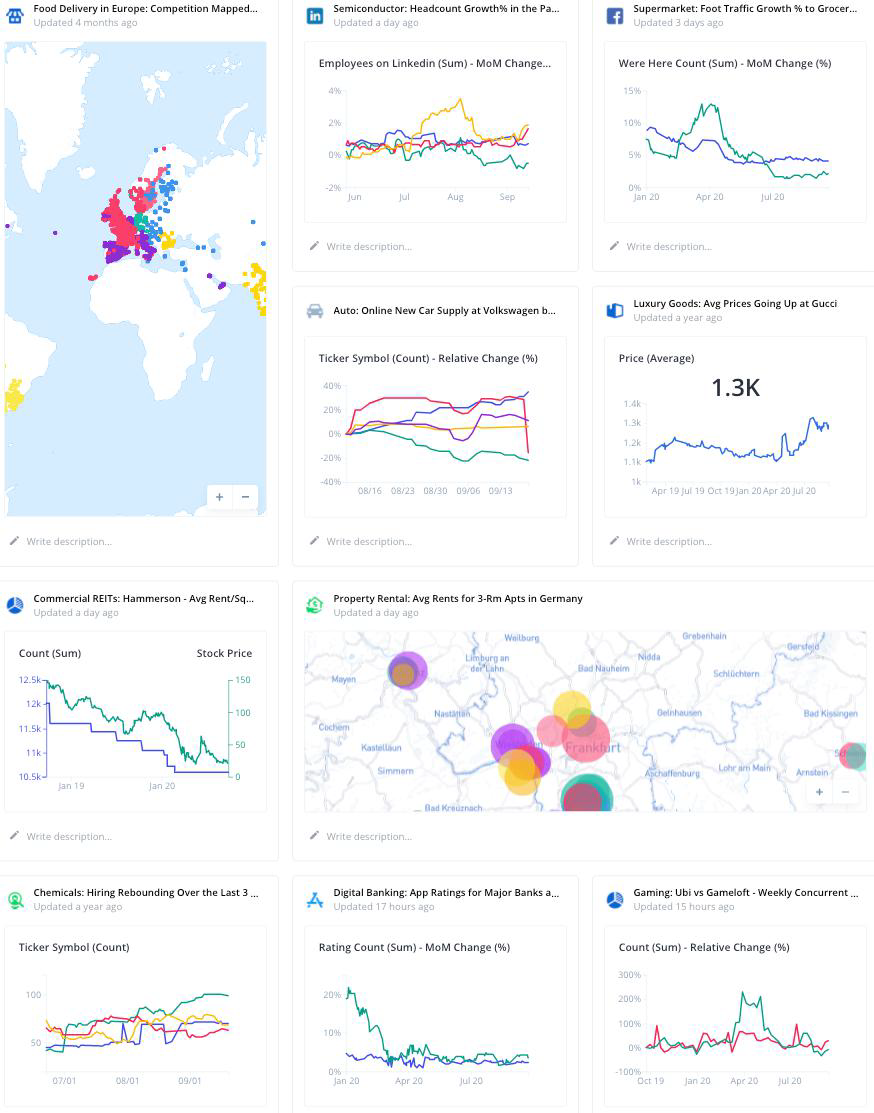

Alternative Data Use Cases for Private Equity Investors

Bridge the Information Gap for Late-Stage Investments with Alternative Data

Savvy private equity investors use Thinknum's alternative data to bridge the information gap between public and private markets. Read on to learn how investors in private markets leverage alternative data for actionable insights.

Job Listings

Compare Job Listings at Web Design Rivals

Hiring can be a valuable leading indicator of future corporate performance. View the number of open job listings at various web design rivals in real-time, for example. Filter to gain in-depth competitive insights into specific market, location, and job categories.

Read more